Q2 2023 Takeaways:

Optimism in the Stock Market

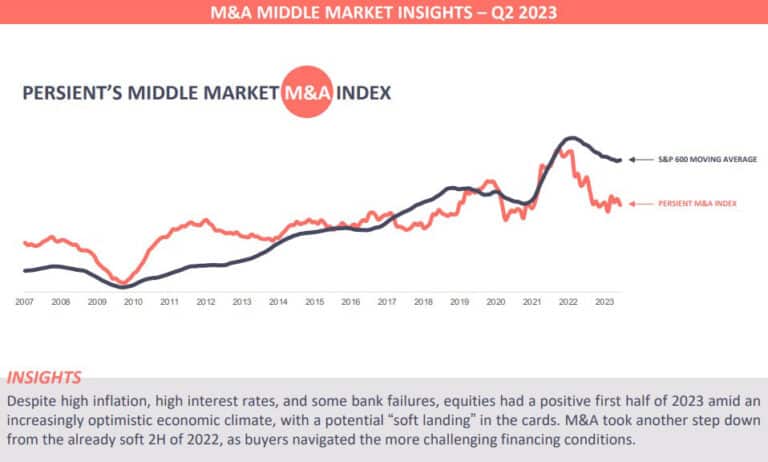

- While the stock market experienced a positive 1H of 2023, dealmaking declined further from the already subdued 2H of 2022.

- Middle market M&A value in the 1H 2023 is down more than 30% as compared to the 2H 2022, while volume is down about 18%, as more buyers remained on the sidelines amid the more challenging financing environment.

- The largest contributors to the stock market gains in the 1H of 2023 were the tech behemoths, Apple, Meta, Tesla, and of course Nvidia, which is the newest member of the $1 trillion club.

Have We Peaked

- With inflation appearing to have peaked and most of the Fed’s rate hikes in the rear view, economic optimism is beginning to reappear, and recession headlines are beginning to disappear.

- Many employers are reluctant to reduce headcount despite increased costs, as the labor market remains very tight.

- Despite a higher cost environment for consumers, the strong labor market has kept the economy chugging along, with consumer confidence reaching its highest level in years.

Dealmaking in the 2H of 2023

- While interest rates are not likely to decline in the second half of the year, better certainty that most of the hikes are behind us should lead to increased interest in dealmaking.

- What recession? Economists have taken a back seat to calling for a recession to occur in 2023, amid the tight labor market and confident consumer.

- The next big thing in tech is here – generative AI – and it is capturing headlines. Expect increased M&A in the space as buyers look to make transformative moves.