Strength Amid Uncertainty for Middle Market M&A

- Global M&A transactions exceeded $1 trillion in value for Q1 2022, largely driven by a spate of mega-deals, such as Microsoft’s $75 billion acquisition of gaming company Activision Blizzard.

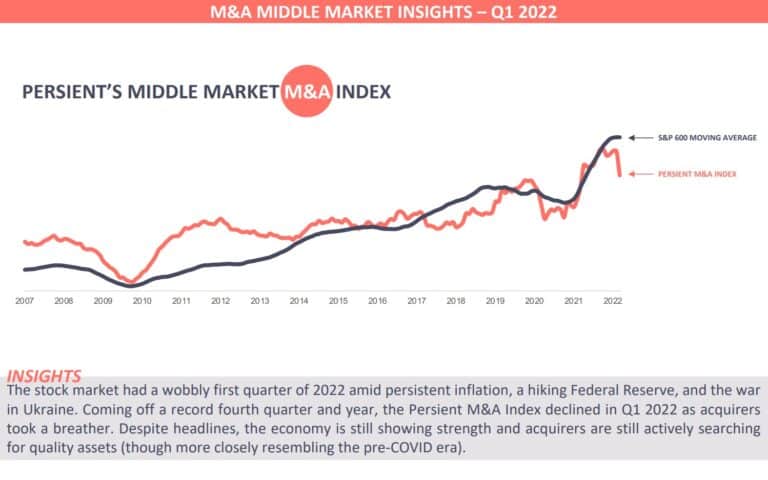

- The U.S. middle market M&A took a breather in Q1 2022 compared to same quarter last year, recording $35 billion in transaction value on 2,185 deals in the quarter, which is about a 25% decline in deal value from Q1 2021.

- M&A activity was still strong, though resembling more of the market pre-COVID.

Why the Jitters

- The war in Ukraine, in addition to the terrible humanitarian cost, is adding to pre-existing market uncertainty and challenges around supply chain, raw materials, and energy. Further, many multinational corporations have been focusing efforts on unwinding operations in Russia, delaying contemplated M&A transactions.

- Persistent inflation from 2021 has carried forward into 2022.

- The U.S. Federal Reserve increased rates by 25 basis points, with further rate increases expected throughout the year – though the level of increases remains uncertain.

Outlook for Remainder of 2022

- Cash is still abundant and the demand for quality assets remains unchanged despite the geopolitical backdrop.

- Though rates are increasing, the cost of capital remains relatively low and attractive.

- CEO economic outlooks and confidence remain positive, with growth ambitions intact.