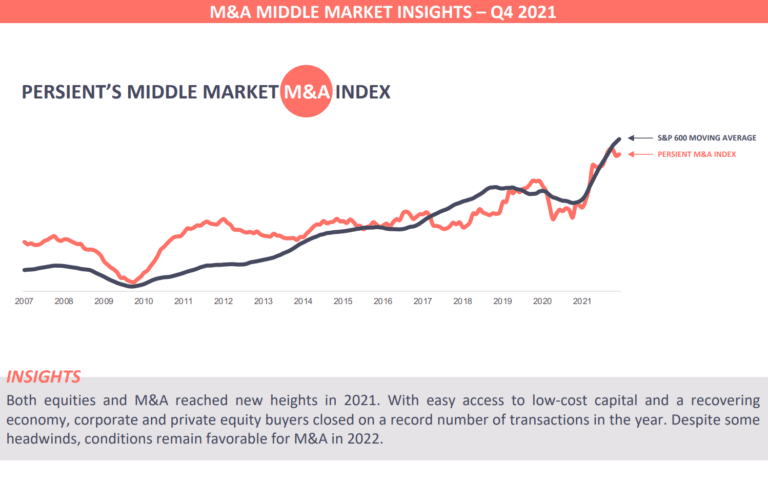

Mergers and Acquisitions Reaches Record Heights

- Q4 wrapped up a record year in M&A, with global mergers and acquisitions deals over 2021 exceeding 60,000 and more than $5 trillion in value, increases of around 25% and 50% from 2020, respectively.

- Within the U.S. middle market, deal volume and values in Q4 2021 exceeded 2,700 and $67 billion, respectively, increases of 33% and 36% from Q4 2020.

- The U.S. was the most active market for M&A in 2021, representing around 60% of the global transaction value.

What Fueled the Frenzy

- With easy access to cheap capital, corporate cash and private equity dry powder swelled to record levels.

- Potential tax increases motivated owners to take chips off the table.

- The COVID-19 pandemic delayed many acquisitions until 2021 and caused a disruption to the ‘status-quo’ in financial transactions leading many companies to scramble to acquire new technologies, processes, people, and products for the ‘new era’ post-COVID.

- With demand for quality assets largely exceeding supply, acquirers had heavy competition leading to stretched valuations.

What’s Next

- Even with contemplated interest rate increases, the cost of capital will remain relatively cheap in 2022.

- With mandates to provide a return, corporations and private equity will continue using their record levels of cash to acquire quality assets.

- Supply chain bottlenecks, persistent inflation, labor shortages, and increased rates will temper the M&A market heading into 2022, especially in the middle market, but the overall strength in financial transactions remains.