Resilience in Dealmaking

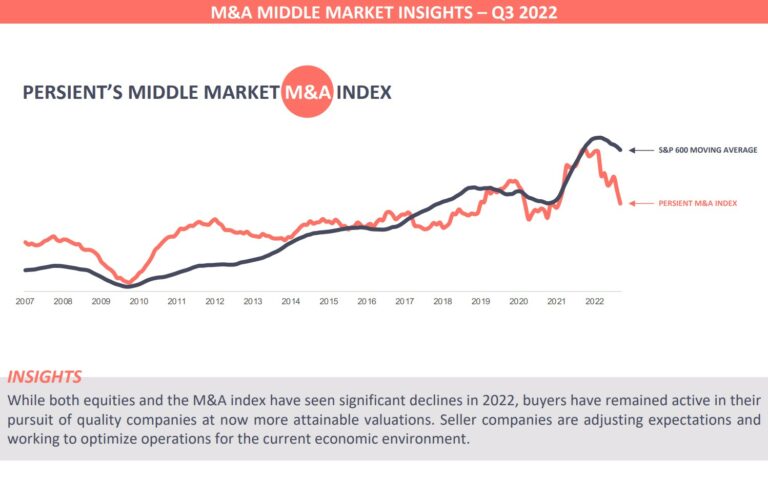

- Both the equity markets and the Persient M&A index have continued declining through the third quarter, reaching multi-year lows.

- Middle market M&A value in Q3 2022 is down more than 40% as compared to the same quarter of last year, while volume is down about 11%, indicating the continued resilience of dealmaking, albeit at lower valuations.

- The sector experiencing the steepest valuation “reset” is tech, while in the face of several economic uncertainties, to no surprise, the consumer staples sector has shown relative strength as investors seek “safety.”

Continued Uncertainty

- The Ukraine-Russia war remains unresolved, pressuring the energy markets further amid OPEC+ production cuts.

- The labor market continues to show strength, likely requiring the US Federal Reserve to continue interest rate hiking and minimizing the likelihood of a near term “pivot.”

- The US midterm elections are approaching in November, with political pundits increasingly seeing the possibility of Congress flipping to Republican power as surging prices weigh on the mind of the US public.

What’s in Store for Q4

- The likelihood of continued market turbulence is high with US midterm elections approaching, a hiking Fed, and global conflict with no near-term solution in sight.

- Recessionary talk will likely continue to capture the headlines as another earnings season kicks off.

- Deal volume is showing buyers still want to do transactions, though valuation expectations may need a reset for sellers as the period of lofty valuations is in the rearview.