A Return to 2019

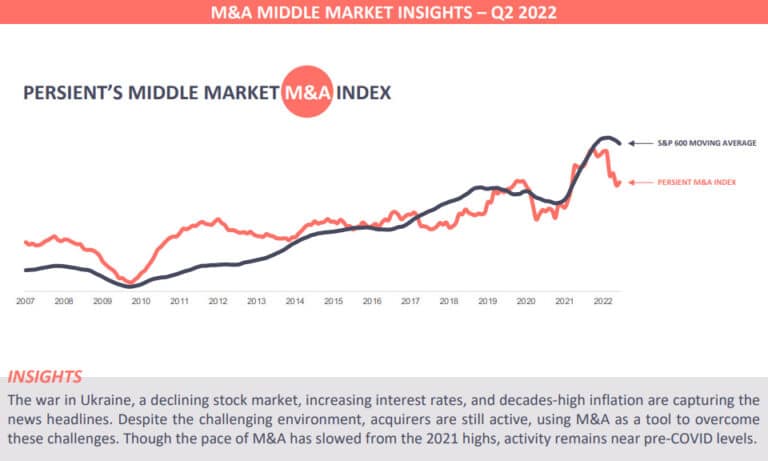

- M&A activity has declined significantly from the record 2021 levels, though remains within the historical average, at levels similar to the pre-pandemic era in 2019, considered to be a strong, healthy year for M&A.

- Compared to Q2 2021, middle market M&A volume and value in Q2 2022 are down 7% and 31%, respectively.

- Volume has fared better than valuation in 2022, with rising interest rates and a contracting credit environment contributing to suppressed valuations.

Headwinds

- Moving towards winter with an unresolved Ukraine-Russia conflict, there are deepening concerns of a significant energy crisis.

- Inflation remains at multi-decade highs and has not yet shown signs of slowing down, largely driven by supply chain issues which likely will not unwind until well in 2023.

- Interest rates continue to rise, while the likelihood of a “soft landing” by the U.S. Federal Reserve appears further in doubt.

Outlook for Second Half of 2022

- There are still trillions of dollars on the sidelines waiting to be deployed, while first half volume indicates the desire to continue dealmaking.

- Acquirers are beginning to view M&A from a different lens, seeing it as an opportunity to overcome current challenges such as supply chain kinks, workforce shortages, and technology lags.

- While valuations are not expected to reach 2021 levels again in the near-term, quality assets will continue to command a premium.